Investing in Innovation for a Sustainable Future

In the ILS Fund, we are committed to bridging these gaps by investing in innovative solutions within the agriculture, food, and healthcare sectors.

Signatories for

“Our investments focus on scalable, sustainable, and impactful innovations that address these critical challenges, contributing not only to India’s inclusive and prosperous future, but also global wellbeing.”

Our investments will align with

Article 9 of the EU SFDR.

India’s Commitment to Sustainability

India stands at a pivotal juncture, experiencing significant economic growth and harnessing its demographic dividend.

Notably, India is emerging as a leader in promoting sustainable practices, with the Government of India championing this effort with initiatives such as

Under age of

However, the Road to Sustainability is Still Paved with Challenges

However, sustainable and inclusive development remains a critical challenge, with key sectors such as agriculture, food systems, and healthcare still facing deep-rooted inefficiencies and inequities.

Agriculture's Productivity Paradox

Climate Change & Resource Scarcity

India loses ~ 20% of its agricultural output annually due to post-harvest losses

Supply Chain & Food System Inefficiencies

Healthcare Accessibility & Disparities

doctor-to-patient ratio of 1:11,082 WHO Recommended: 1:1,000

59.2% of healthcare infrastructure focussed in urban area serving only 27.8% population

Investment Objective

Investment Objective – At ILSF, we invest in deep tech ventures aligned with Article 9 of the EU SFDR, driving sustainability in agriculture, food, and healthcare while addressing climate, food security, and healthcare inequities.

Climate-resilient Agriculture

Sustainable Food Systems

Tech-driven Healthcare

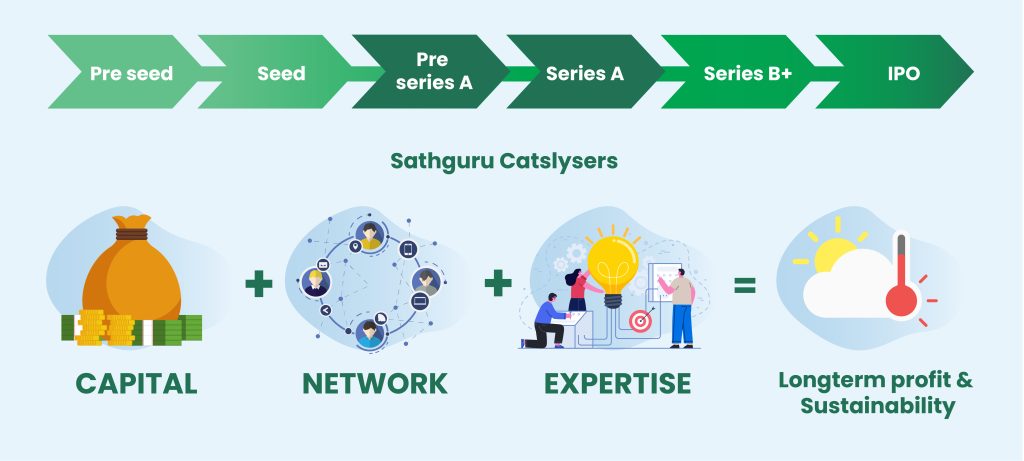

Our Approach

To invest in solutions that make a difference. We do this by supporting early and growth stage businesses that merge scientific innovation with market-driven solutions to create scalable impact.

Backing IP-driven breakthroughs

ScalingESG-aligned

Driving global impact

Building on the success of our previous fund, we remain deeply committed to advancing the UN’s Sustainable Development Goals, ensuring our investments drive meaningful and measurable impact.

At the ILS Fund, we harness decades of operational excellence and a powerful global network not only to drive meaningful impact but also maximize financial returns for all stakeholders.

Investment Themes

Ag-Tech

Pre & Post-Harvest Tech

Food-Tech

Functional & specialty foods

Novel foods – alternative proteins, nutraceuticals

Animal Health & Nutrition

Med-Tech & Digital Health

Telemedicine & remote patient monitoring

Affordable & accessible medical devices

Specialty Care & Biotech

Biosimilars & vaccines

Preventative & wellness care

Portfolio

Telluris Biotech

Telluris is an innovation led enterprise pioneering the development of novel nematicides targeting highly destructive root knot nematodes.